bursa malaysia fcpo

FCPO adalah salah satu dari produk futures yang ditawarkan oleh Bursa Malaysia Derivatives BMD. Future merupakan satu produk derivatif yang boleh didagangkan melalui Bursa Malaysia.

According to Bursa Malaysia Derivatives Bhds BMD chief executive officer Samuel Ho the average daily contracts traded in 2020 grew 33 to more than 73000 a historical high for the derivatives exchange.

. In 2020 the Exchanges port tank installations in Peninsular Malaysia delivered 670125 metric tonnes of Crude Palm Oil via its Crude. Bursa Malaysias crude palm oil futures FCPO has continued to achieve new highs this year Bursa Malaysia Bhd chairman Tan Sri Abdul Wahid Omar said. In March it hit a new record monthly trading volume of 166 million contracts and the highest daily trading volume with over 125000 contracts he said.

The plantation company decides to hedge 50 of the production up to 6 months forward onto Bursa Malaysia Derivatives FCPO. Yang menariknya keuntungan yang tinggi di dalam FCPO membuatkan ianya satu keterujaan bagi para trader. Ia adalah produk futures yang mematuhi syariah syariah compliant yang disandarkan kepada market fizikal kelapa sawit dunia.

FCPO adalah kontrak niaga hadapan minyak sawit mentah MSM dalam Ringgit Malaysia RM yang didagangkan dalam Bursa Malaysia Derivatives memberi peserta pasaran satu tanda aras harga global bagi Pasaran MSM. But in international market they are refering FCPO instrument as MPO or KPO. Crude Palm Oil Futures FCPO is a Ringgit Malaysia MYR denominated palm oil futures contract traded on Bursa Malaysia Derivatives BMD which acts as the worlds price discovery benchmark for Crude Palm Oil since 1980.

In Malaysia we use FCPO for the instruments symbol. For Malaysian trader we can easily contact one of the registered brokerage listed under Bursa Malaysia website. Options on Crude Palm Oil Futures OCPO OCPO is a Ringgit Malaysia MYR denominated Options Contract traded on Bursa Malaysia Derivatives with Crude Palm Oil Futures Contract FCPO as its underlying instrument.

The launch of the new contract came against a backdrop of Bursa Malaysia crude palm oil CPO prices rising to RM5000tonne US1205tonne on 6 October amid concerns over tight edible oil supplies and the higher export estimates for the coming Diwali festival the commodity exchange said. There was a spike in the trading volume of crude palm oil CPO futures contracts on Bursa Malaysia last year. 5577818181818182 Bursa Malaysia Berhad Month Price Prices are quoted in Malaysian Ringgit per metric ton The average spot month settlement price of Crude Palm Oil Futures FCPO The average spot month settlement price of East Malaysia Crude Palm Oil Futures FEPO.

FCPO is a Ringgit Malaysia MYR denominated Crude Palm Oil Futures Contract traded on Bursa Malaysia Derivatives BMD providing market participants a global price benchmark for the Crude Palm Oil Market since October 1980. KUALA LUMPUR March 24. Operating a fully-integrated exchange Bursa Malaysia offers a complete range of exchange-related services including trading clearing settlement and depository services.

The Malaysia Derivatives Exchange. Bursa Malaysia Berhad is one of the largest bourses in Asia with about 1000 listed companies offering a wide range of investment choices to the world. The partnership involves swap of ownership.

To check just go to the Bursa Malaysia website klik on the Broker link. On 13th April 2012 the trader sold 400 contracts or 10000 MT in each month up to Sept 2012. Sandakan and Lahad Datu accounted for 1057 and 1237 respectively of total export volume in 2020MPOB data showed.

FCPO to establish Malaysia as the global benchmark for the commodity. Chicago Mercantile Exchange holds 25 of the equity stake while the remaining is held by Bursa Malaysia Berhad. According to Bursa Malaysia the FEPO mirrors almost all of the FCPOs current specifications with some enhancements specific to East Malaysia offering delivery through three ports.

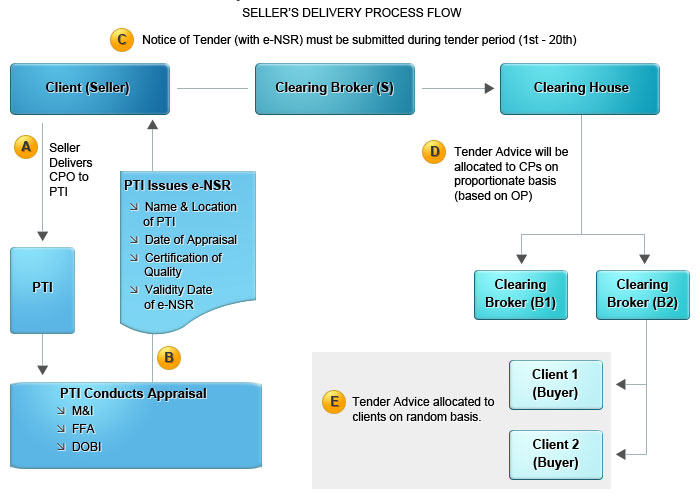

FCPO Physical Delivery Derivatives Clearing Settlement Bursa Malaysia Derivatives Clearing Bhd BMDC is an approved Clearing Houses under Capital Market Services Act CMSA and provide clearing settlement services for the derivatives market. Apa itu FCPO. They are Sandakan Lahad Datu and Bintulu.

Bursa Malaysia Derivatives FCPO contract allows the plantation company to hedge up to 2 years forward by selling futures contracts. FCPO ataupun Future Crude Palm Oil adalah salah satu instrument pelaburan yang wujud di Malaysia. BMDC clears and settles futures and options contracts executed on Bursa Malaysia Derivatives Bhd.

Weak Export Demand Bring Down Cpo Prices After Continuous Strong Gains The Edge Markets

The Basic Of Commodity Derivative Crude Palm Oil Futures Fcpo Shareinvestor Academy Malaysia

Cpo Futures Forecast To Trade Higher Next Week The Star

Bursa Malaysia Derivatives Total Trading Volume For Fcpo Contract Breaks All Time High Businesstoday

Fcpo Bursa Malaysia Crude Palm Oil Futures Home Facebook

Bursamalaysia Fundamental Data For Trading Bursa By Bursamalaysia Fundamental Data For Trading Bursa Malaysia Derivatives Palm Complex Products Apr 2022 Malaysian Palm Oil Board Mpob Data Shows That The Crude Palm

Bursa Malaysia Trading Hours Pdf Futures Contract Derivative Finance

Bursa Marketplace Learn Try Apply

Growing Futures Markets The Star

Teknik Fcpo Sebenar Home Facebook

Cpo Futures Hits 12 Year High At Above Rm4 000 A Tonne The Edge Markets

Crude Palm Oil Futures Set To Exceed 12m This Year

Fcpo Bursa Malaysia Crude Palm Oil Futures Home Facebook

Webinar Video The Strategies Of Trading In Fcpo

Bursa Malaysia Derivatives Launches East Malaysia Cpo Contract Fepo

0 Response to "bursa malaysia fcpo"

Post a Comment